Staff Wellbeing in the Modern Day

Modern business practices have begun to place increasing consideration on staff wellbeing and everything which this entails. Most people in the workforce will spend a huge part of their waking lives at work, with their daily lives being structured around work shifts, and often taking issues which arise at work home with them.

Throughout the last three decades, and in particular the past ten years, companies have begun to understand the importance of acknowledging staff wellbeing problems. Rather than denying the existence of such problems they have conceded that it is not only the ethically correct decision, but also serves as a sound business choice to tackle them.

Staff wellbeing at its core is primarily concerned with an employee’s personal happiness; it is about them being physically healthy, feeling mentally sound and being in control of their financial stability. Consequently, it is imperative that we do not allow work, and all of its inherent pressures, to undermine our basic purposes and needs in our life and by extension the lives of our friends and loved ones.

What Benefits can you Expect to Receive from Enacting a Thorough and Competent Staff Wellbeing Policy?

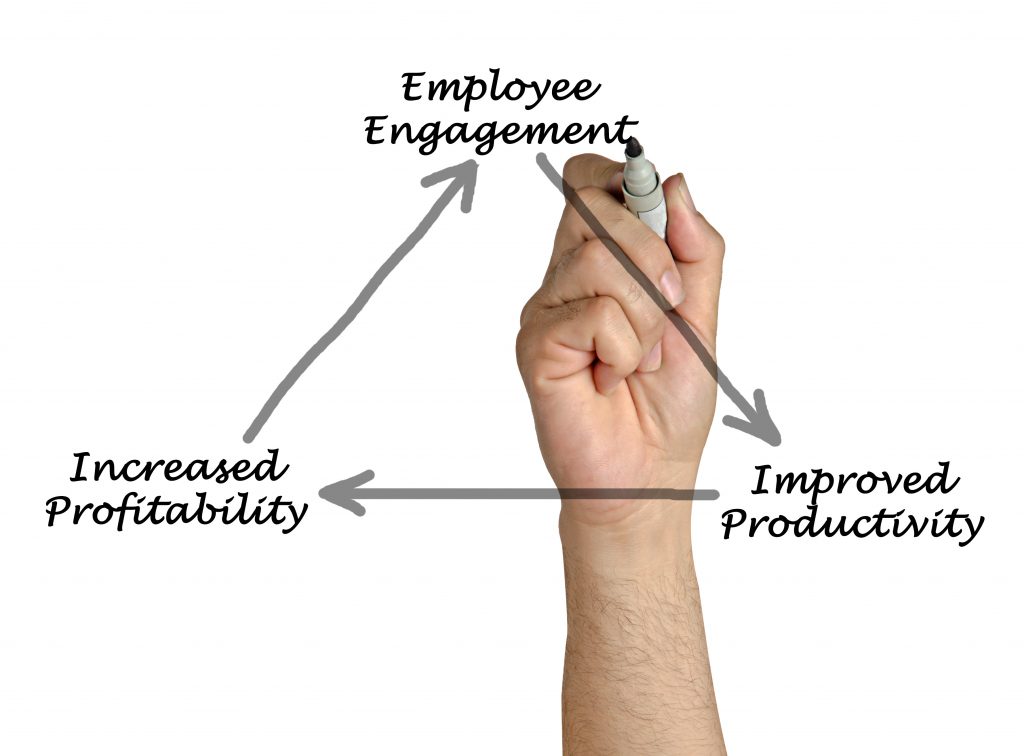

Nurturing your employees’ wellbeing is not only beneficial for the people concerned, there are many advantages linked to a company’s performance. Endorsing your staff’s wellbeing can reduce their stress levels, enable them to deal with pressure more effectively, and creates a more positive and productive work environment.

The success of any company is intrinsically intertwined with the performance of its staff, if the work place encourages motivation and positivity then this will, by proxy, lead to better results for that company. According the CIPD “Good health and wellbeing can be a core enabler of employee engagement and an organisation’s performance”.

There is a wealth of academic findings that support the statement: “Happy and healthy employees increase your profit margins”. Firstly, it has been confirmed by numerous studies that healthy employees cost less for companies to employ, this in and of itself is not too difficult to understand. Healthier employees will have fewer absences, stay in a settled position for longer (removing recruitment and retraining costs), and will require fewer treatments for chronic illnesses.

Whilst health considerations are more obvious, many company leaders will be surprised to find out just how much can be gained from having a happy staff. In 2014, a study was conducted by the University of Warwick involving a number of experiments, all to test whether happier employees worked harder. They concluded that happy employees were, on average, 12% more productive.

A Warwick Professor stated that companies, such as Google, who invested more in employee support have seen employee satisfaction rise as a result. Referring to Google in particular, satisfaction rose by 37% due to their wellbeing policies. This in turn saw employee work level metrics increase significantly. The conclusion being “The driving force seems to be that happier workers use the time they have more effectively, increasing the pace at which they can work without sacrificing quality”.

As employees are the greatest asset a company may have, the health and wellbeing of an individual is in turn the greatest asset they have. Therefore, it makes logical sense to ensure that they are in optimal condition. A 2018 survey found that respondents whose organisation had implemented health and wellbeing activities in 2017 reported positive results covering a number of categories; Improved employee morale and engagement (44%), a healthier and more inclusive workplace culture (35%) and reduced lower absence rates (31%).

How can Investing in Employee Wellbeing Today Help your Bottom Line?

The costs associated with sickness absence have been extensively covered, however, some company leaders fail to appreciate the relative fiscal impact it may be having on their business.

To provide a degree of scale, in the NHS Health and Wellbeing Review (2009) it was stated: “Reducing current levels of sickness absence across the NHS by a third would result in a gain of 3.4 million days a year, equivalent to 14,900 extra whole-time equivalent staff and an annual direct cost saving of £555 million”.

Following this, the Office of National Statistics (ONS) estimated 137.3 million working days were lost due to sickness or injury in UK in 2016 alone. This is the equivalent to an absence of 4.3 days per worker. It should be noted that this was the lowest number recorded since the ONS began recording these figures in 1993, where the number of absentee days was at 7.2 per worker. There has been a gradual reduction in the number of work absences since 1993, with a contributing factor being the adoption of wellbeing policies into mainstream corporate culture.

According to a PwC study carried out in 2012 the average London firm of 250 employees loses approximately £4,800 per week due to sickness absence. This amounts to £250,000 in a year and will no doubt be much higher for larger firms. Given these findings it is clear that employers will have a vested interest in improving the health of their employees.

As individuals will spend a significant portion of their lives at work, employers have the opportunity to influence the performance and behaviour of large numbers of people through comprehensive staff wellbeing policies.

The ramifications of poor employee health include:

- Individual – In addition to the physical and mental ‘cost’ resulting from ill-health of the employee, financial costs linked to potential loss of income need to be accounted for, and if there is an extended period of ill health, and potential loss of employment.

- Employers – Output losses due to sick pay, reduced manpower, a less cost-effective use of agency staff, and recruitment costs.

- Society – Cost of healthcare, benefits incurred, taxes foregone and an overall adverse impact to surrounding family and friends.

As seen above, the physical, mental and financial wellbeing of an employee are leading factors in determining productivity, retention rates, healthcare costs and company profit margins. From these findings it becomes evident that any company that does not account for their staff’s wellbeing will be negatively affecting their business model through omission to act.

Supporting this is the fact that FTSE 100 companies that prioritise employee engagement and wellbeing outperform the rest of the FTSE 100 by over 10%. With wellness initiatives resulting in benefits such as a decrease of 25% fewer sick days annually, one can argue that staff wellbeing policies are a key component is a company having an edge over its competition in today’s modern business world. Ignoring the value of a correctly implemented wellness policy would be to disregard the need to adapt in an ever-changing economic landscape.

How do you Address Workplace Wellbeing?

Workplace wellbeing should be an integral part of the overall company strategy for a productive and healthy workplace. Utilising health and safety legislation combined with pre-existing workplace policies or health programmes can help lay the foundation for an effective staff wellbeing policy. Ensure that when creating a specific programme, you include training and management support where possible.

Workplace health programmes refer to coordinated and comprehensive sets of strategies and related activities, initiatives and policies developed by the employer, with discussion and suggestions conferred by their employees, to progressively improve the working life, health and wellbeing of staff.

Remember to consider any potential dangers which your employees may be exposed to during their working hours and any additional dangers which may be introduced through your wellbeing initiative. With regards to the UK, the relevant directions to reference can be found in the Workplace (Health, Safety and Welfare) Regulations 1992.

What are some of the key factors to consider when implementing a Staff Wellbeing Policy?

When preparing a Staff Wellbeing Policy ensure that you confirm:

- What is your Objective? Know what outcome you want to bring about through your policy.

- Who is your Target Demographic? Is the policy aimed at all of your staff or select groups? Also consider how flexible your policy needs to be in order to accommodate the selected members.

- What type of initiatives will be enacted in your campaign? Are you aiming to promote physical health more heavily than other aspects at the outset or is there a need to focus more resources on mental or financial wellbeing?

- What will be the budgetary requirements of your policy? Will implementing your ideas involve significant expenditure? You will need to conduct a costing analysis to calculate the optimal way to allocate your budget. Prioritise what to address in order of what negatively affects your staff the most, whether these factors are Physical, Mental or Financial.

- Should a separate board/team be established be to implement the changes? Generally, a management/staff committee is recommended, and has the advantage of being able to work with key groups at your company, including any individuals tasked with managing health and safety. Depending on the size and demands placed on the company, these teams can work separately or as part of the health and safety committee.

What steps need to be taken in order to implement an Effective Health and Wellbeing Strategy?

Step One: Discovery

The current state of your staff’s health should dictate the direction of any strategy you wish employ. It is highly advisable that intelligence is gathered from a range of sources, including; claims data, reports on sickness absences, staff turnover, health assessment information, health service usage, specific health conditions and employee satisfaction and pulse surveys. This aggregated data will form a comprehensive healthcare audit. An analysis of these findings will enable a company to formulate an effective plan, that has a realistic, quantifiable and clear criteria for success.

Whilst many organisations have a well-established range of approaches used to manage sickness absence, the CIPD found in their Health and Wellbeing at Work Survey (2018) that a focus on measuring and managing absence alone is not sufficient in informing a company’s approach to encouraging a healthy working environment. More than one in ten organisations surveyed had unexplained absences as one of their three main causes of short-term absence. Potential reasons for this could include a lack of genuine reports, with employees being fearful of reporting the real reason for their absence to their manager, should it relate to a topic they are sensitive about e.g. mental illness.

When gathering information be mindful about any potential holes in your collected data. Any areas which have significant omissions ought to be addressed and evaluated. These areas should be judged on whether the insight their data delivers could have substantial contributory effects on the overall policy strategy.

Step Two: Creating a Vision

Once you have the necessary information required to build a wellbeing strategy, you need to cultivate a vision of how your policy will affect both your staff and the commercial objectives you have set.

When choosing what problematic areas to address an equal weighting should be afforded to preventative and reactive approaches to wellbeing. As the adage goes, “Prevention is better than the cure”, and where possible a policy should aim to prevent an employee from being exposed to negative experiences in the workplace. This would serve as a cost-effective way of improving wellbeing.

In recent years mental health has emerged as an even more significant challenge for companies to face than previously thought of. The CIPD found that 22% of organisations report mental health as being the primary cause of long-term absence. This is a substantial increase from the reported 13% in 2016. Alongside this, over 30% of the UK workforce is over the age of 50, with the number of individuals classified as obese reaching 26% in 2018.

Provisions ought to be put in place to remedy issues such as these which may affect wellbeing, both at the workplace and at home, so long as they align with a company’s overall commercial objective.

Step Three: Securing the Required Resources

Depending on the structure of company in question it may be necessary to persuade senior management to invest appropriately in staff wellbeing initiatives. In the UK, organisations still vary noticeably in how proactive they are in promoting employee wellness.

A 2018 survey by Simplyhealth found that a higher proportion of organisations have a standalone wellbeing strategy in comparison to a similar survey taken two year prior. It was also reported that one in five companies are not carrying out any policies to improve the wellbeing and health of their employees.

In order to convince sceptical senior management or board members on the merits of a correctly employed wellness policy, it is necessary to devise a reliable business plan which covers the methodology of implementing a wellbeing policy, with a framework outlined on delivering measurable objectives.

These measurables will set the standard for success and will need to be assessed on an ongoing basis. They can include measures such as reduced sickness absence (days/hours recorded), the savings made on sick pay, workload efficiency (how long an employee takes to complete an action compared to before the policy was enacted), staff retention rates (accounting for recruitment and training expenditure) and staff engagement levels.

Depending on the size of the company it may be recommended to include appointing a dedicated employee who can plan, implement, communicate and measure any strategies put in place.

Step Four: Communication and Engagement

An integral part of any policy is ensuring all activities and measures taken are communicated in a clear and understandable way. This is vital as ineffective communication of your policies will result in the majority of your workforce not engaging in the implemented measures.

Review and confirm every stage of the campaign ensuring a clear and compelling message is in place, using methods that have been catered towards your staff. This will demonstrate your organisation’s commitment to improving employee wellbeing.

This can be further built upon by appointing employees as health representatives and having them help implement and increase exposure of the policies designed and their inherent benefits. Management ought to engage as positive influences who actively and openly support the goals of your wellbeing campaign.

Once your policies have been launched look to keep a line of communication with your employees so that your campaign can maintain its momentum. The method of communication can vary; weekly updates via email, progress meeting held on a regular basis, onsite activities and many others can be used. Using mediums that your employees frequently utilise themselves is suggested, however, add a fresh spin on the communication to retain attention.

A Policy Example: NHS Health and Wellbeing Framework

To gain a better understanding of a wellbeing policy already in place, the NHS Health and Wellbeing Framework can be referenced. Last year they updated NHS employers.org to align with the wellbeing framework they launched.

The eight elements the NHS identified as critical to delivering an effective health and wellbeing policy were: Leadership and management, an organisation wide plan, “know your data”, communication, engagement, healthy work environment, health interventions, evaluate and act. It should be noted that these elements can be viewed as a more detailed and specific framework version than the four steps mentioned prior.

The NHS put emphasis on the notion that to approach sickness absence effectively all of the aforementioned elements have to be implemented together. It is understandable to see why this is done, trying to imagine an operating framework without aspects such as leadership or communication is very difficult. A logical conclusion drawn from using a framework without one of these key components would be that said framework is bound to fail.

An underlying factor to any effective campaign is to appear competent to onlookers, failing to appear as such would only lead to the targeted demographic to lose faith in the agenda at an early stage.

Referring to previous examples of wellbeing policies is highly recommended as they can provide information and ideas on what a particular company ought to implement in order to see positive results.

The 3 Key Elements That Should be Addressed in a Comprehensive Wellbeing Strategy:

Physical Wellbeing

Having a healthy body is very important, and this basic notion is reflected by the fact that most traditional workplace wellbeing policies place a strong focus on physical features. Although these standard policies use health risk appraisal surveys, on site examinations and occasional seminars to promote healthy lifestyles they fail to understand that physical wellbeing encompasses more than this.

Firstly, the view that physical wellbeing is merely the absence of disease is far too narrow. Being physically well determines the energy levels and vitality shown when completing unremarkable tasks with ease. Whilst avoiding health risks is imperative, it is not only avoiding the negative that a wellness policy aims to achieve, but instead emphasising and building upon the positive aspects of being physically healthy.

Educating employees on the benefits and methods by which one can improve their physical health is vital. This should be further built upon, however, by encouraging healthy habits through the introduction of physical activities which will inspire a constructive change in behaviour with regards to wellbeing.

Unfortunately, better health can very rarely be achieved by simply rewarding or penalising someone towards a healthy lifestyle. Instead, look towards developing an environment that supports overall wellbeing and makes being healthier the easier choice. It has been proven that people who are healthier and fitter perform better in mental tests and show more creativity when compared to inactive individuals. Active lifestyles encourage active mindsets.

The following suggestions list various ways in which a company can encourage a more active and vigorous lifestyle:

Go to the Gym/Get Moving: “Your chair is not your friend” – It is all too easy to fall into a sedentary lifestyle. Many people spend vast amounts of time sitting every day and this can have serious repercussions if actions are not taken to compensate for this static routine.

Tackle this by encouraging employees to stand up and be proactive for a few minutes each day. Any movement from short walks to stretching can have a substantial effect on one’s physical state. If there are any gyms in the vicinity of the workplace then look at potential gym membership schemes. With a global meta-analysis studying and discovering a link between sedentary time and its association with a heightened risk for disease, mortality, and hospitalization in adults, it is more important than ever to get employees out of their chairs.

Walking Meetings: Meetings are a staple of business where we meet to negotiate and discuss new initiatives and deals, analyse and review performance and get feedback on designs. The standard meeting design is not beneficial for our wellbeing as it invariably involves sitting around a table, broaching stressful subjects whilst being inside and exposed to artificial lighting.

Following the example of leading business man Richard Branson, who regularly employs the tactic of having walking meetings, may yield more beneficial results than might be anticipated. Attendees can become tired and unfocused if a meeting drags on for too long, disengaging from what is being discussed. This will result in little to no progress being achieved. By making your meetings more mentally and physically stimulating by walking and talking it is more likely that more constructive discussions will be had.

Travelling To and From Work: If any of your employees are local to your workplace, installing a bike rack so they have somewhere to safely chain their bicycle may encourage them to use this form of transport more frequently. Depending on the size of the budget available for transforming your workplace to be more health-centric, you could install a shower to encourage activity both on the way to and from work, as well as during lunch.

Be mindful of any safety issues which may arise when encouraging your workforce to walk home, with particular forethought being given if early or late shift work is involved.

Sponsored Challenges: Tackling a physically challenge such as Tough Mudder, the couch to 5k or a mini marathon can be an excellent jump start in motivation for people in the workplace to start exercising. A goal, a deadline, and the added incentive of supporting a charitable cause can incite an individual who may not be strongly inclined to swap the living room couch and TV for a pair of running shoes.

Gamification: Organise friendly competitions within the workplace centred around some form of physical activity. Making healthy activities more socially enjoyable provides an approachable gateway for more reserved employees who may be more inclined to participate due to the presence of their colleagues.

Social Fitness Challenges: Online social fitness challenges can engage a large amount of your workforce without disrupting a day’s workflow. These challenges are inexpensive and require little preparation time when enacting them. By using one of a number of applications it is possible to engage with sizeable numbers without affecting their work schedule.

Due to ability to work online these applications can be used to build communities, and even run inter branch competitions for larger corporations.

Eating Habits: Though doing exercise has a major physical upside, it can be harder to convince an employee to get up and be active than changing a sugary snack for a healthier alternative. Having a cleaner diet will provide employees with higher energy levels and more alert minds. Sharper minds will result is higher quality products and service being produced. Analyse what the current eating culture your company promotes is and aim to make changes which can slowly but surely influence the behaviour and preferences of your workforce.

Aim to replace excessively fatty and sugar filled food and drink with more nutritious substitutes. The methodology used can include booking more nutritious food outlets when organising staff functions or socials, and changing the food offered within vending machines to a healthier selection. One of the simplest oversights companies make when implementing these health policies is that they tend to overlook the importance of food preparation. Nothing would be more counterproductive than your staff wholeheartedly embracing your new policy and there not being enough storage facilities to accommodate their new, healthier eating habits. Make sure to project any potential storage requirements and act accordingly.

Snacks: Snacking a healthy eating practice as providing the body and brain with a steady source of energy will result in more attentive mindsets. A common occurrence is one or more work colleagues bringing in chocolates and sweets into the workplace to share with everyone. A quick and easy step in replacing this unhealthy eating habit would be to swap a serving of chocolates or sweet with fresh fruit, nuts and other wholesome replacements. Remember to keep track of employee allergies if this method is used.

Avoid Sugar Slumps: The post lunch sugar rush may make a person feel good for 1-2 hours, but the inevitable slump follows soon after. Teach employees different ways in which they can fuel their body in order to maintain high energy levels and avoid slumps.

Sleep: Having enough sleep is essential in guaranteeing the upkeep an individual’s physical wellbeing. A good night’s sleep has numerous benefits such as clearing out stressors from the previous day and raising energy and mood levels for the following day.

Having healthy sleeping habits is important for employee wellbeing and efficiency. Sleep deprivation across the US workforce costs the nation’s economy up to $1 billion per year.

One simple solution to combating tiredness at work is to offer a facility where employees can have 20-minute power naps. These power naps boost alertness and improve overall performance. As many have experienced, when a person is tired and working their work output can drastically decrease with the likelihood of costly errors being made increasing. Whilst it may be unattractive for management to provide an additional reprieve the long-term benefits would more than make up for any time lost initially.

Evaluation of Staff Physical Wellbeing Policies

Showing concern for an employee’s physical wellbeing is a strong indicator for a competent and caring organisation that will inspire loyalty. The fiscal benefits will be seen in both the short and long term as there will be savings made on health care costs and worker productivity should see a gradual upswing. With the promotion of physical activities there will be more frequent opportunities for team building to occur improving the overall working environment as employees will encourage each other to greater fitness heights.

When employing these methods ensure you first understand your staff and their health needs. If you are serious about making your staff more physically healthy then communicate with them first. Put out surveys and have one-to-ones with them identifying health goals and obstacles that enter their everyday lives.

Offering encouragement and incentives to become healthier are a necessity when kickstarting your policy. It is very hard to refuse a tasty piece of cake or wake up and decide to bike or walk to work instead of taking transport. As such, many of us need extra incentives and rewards to motivate us on our journey. These rewards can include things such as an extra day off, gift vouchers, lower health insurance premium, cash rewards and more.

Another proactive stance to take would be educating and inspiring your workforce into being more engaged with your policy. Inviting health and fitness professionals to mix with your employees and find out their physical state and nutrition would be a good way to track progress. From building personalised workout and diet plans to checking their progress and advising them on ways to be more active would make them more accountable. This would reiterate the point that your wellness initiative is to be taken seriously.

Including physical examination and engagement surveys ought to be a key component is tracking your staff’s physical direction. Understanding the differences in cultures between divisions and work teams will allow you to operate the policy in a flexible manner, addressing areas and employee bases where there may be obstacles that need to be analysed and readdressed.

Mental Health Wellbeing

Many employees can struggle to find a healthy work-life balance, and this can have a detrimental effect on their mental health. In the past 10 years there has been a growing attention brought to the realm of mental health and how it needs to be treated.

It is widely reported that mental illness will affect at least one in four people at some point in their working lives. A long-standing practice has seen staff members who suffer from mental health disorders be discriminated against in the workplace and unemployment rates affect the long-term mental health disorder demographic more than any other group of disabled people.

The umbrella of mentally ill health ranges from depression, anxiety, stress, obsessive compulsive disorder, schizophrenia, bi-polar disorder and psychosis. This illness is often connected to substance abuse (either drug or alcohol) and eating disorders (anorexia and bulimia).

The importance of employee mental health in the corporate landscape can be demonstrated by the estimated total cost to UK employers being £8.2 billion annually due to a reduction in work productivity and sickness absence.

A poll carried out by recruitment specialists The Core Partnership and the ICSA: Governance Institute found that board level action on employee wellbeing and mental health is insufficient. Concurrently a 2018 Report supported these findings with 61% of employees surveyed having experienced a mental health issues due to work, or where work had been a contributing factor.

With mental health affecting such a high number of people and being a predominant cause of long-term work absence, it is no wonder that greater attention is being given to this aspect of wellbeing in recent years. However, whilst the focus on improving mental health is gradually coming to the forefront, there are major obstacles in place which need to be addressed.

Mental Health and Management

The mental health charity Mind found that 30% of staff members disagreed with the statement “I would feel able to talk openly with my line manager is I was feeling stressed”. This is a major hindrance when attempting to implement mental health policies since communication is vital for a mental health policy that seeks to address issues specific to your workplace. If you are unaware of the relevant problems employees are facing, then the effort used in carrying out wellbeing policies will be wasted. 60% of employees stated that they would feel more interested and likely to recommend their company as a good place to work if their employer took effective action in support mental wellbeing.

Elaborating on this disconnect Mind also found 56% of employers would like to do more in improving staff wellbeing but felt they lacked the right training or guidance. From this it can be deduced that a pillar of any policy will be the appropriate training of the management so that they can manage and support staff who experience mental health issues.

Managers are a key influence in shaping an employee’s mentality and must lead by example. The manner in which a staff member is supported and managed can be key in shaping how the affected individual copes and recovers. The ideal manager will build up the confidence of their employees, normalise mental health issues and be attentive to your employ’s specific needs. Stronger resilience, coping skills and recovery are the result of mental health policies being carried out effectively by management.

Every company operating a mental wellbeing strategy should give managers training on mental health and stress management techniques, including how to spot the signs of mental illness and how to interactive with staff in a supportive way. In addition, installing clear guidelines on handling mental health issues will encourage positive management behaviours.

The subsequent proposals will expand upon areas of management training and other aspects of a work environment, serving a starting point of reference for any mental health policy:

Internal and External Support Pathways: Employees, and often management, are not aware of all of the pathways available to them to get support. Confirm and reiterate to all staff members how mental health will be managed in the workplace and what avenues of support they can follow to receive help.

Remember that managers experience mental health issues just as much as those they manager, if not more in many cases. Therefore, it is important to address any mental health problems they may suffer from, before they in turn aim to enforce your policy methods. Encouraging and supporting positive management mental health and behaviour will reap many benefits both for wellbeing and your company’s performance.

Open Door Policy: From the owners to management to employee level will allow any significant issues to be brought to the attention of the relevant higher-up and can help bring to light any gaps which may be present in an existing mental health policy.

This policy has numerous benefits, a primary one being that you will be operating a proactive, rather than reactive, approach to employee wellbeing. If employees bring attention to issues, they, or a colleague, are having then it may be possible to prevent the situation from escalating in severity or even outright preventing any negative repercussions.

Flexible Working Arrangements: Allowing for more flexible work hours does a number of things. First of all, it empowers an employee to alter their work habits to fit around their family’s needs, as well as allowing them to keep working on projects that give their lives additional purpose. This also is a show of trust towards your employees as permitting them to set their own schedules, so long as they meet deadlines and bring about desirable results, will make them feel as if they are in a partnership with your company, rather than being mindless drones.

Job shares, working part-time and working from home where possible can have a tremendous effects on a work-life balance, and by extension an individual’s mental state. Encouraging employees to leave the office on time so that they can spend more time with their families and get enough sleep would be an added bonus and show a genuine care for an employee’s welfare. Doing this has the added psychological effect of motivating them to work harder for you as they want to return the trust and care shown for them by producing high quality work.

Work Environment: According to The World Green Building Council Report on Health, Wellbeing and Productivity in Offices, there is a strong connection between office designs and the impact they have on productivity levels and staff morale. This is not hard to understand as noise levels, space, temperature and light can all affect wellbeing.

Get advice on how to improve the work environment and act to ensure the workspace is optimised. Space dividers, quiet areas and guidelines on respectful behaviour will help manage noise levels.

Educate Employees on Emotional Intelligence: Discussing concepts such as mindfulness in the workplace is a good starting point, however, the learning should not stop there. Encourage employees to raise their emotional awareness by organising learning courses teaching practical exercises designed to improve mental resilience. Superior mental strength will improve performance and productivity in the workplace, whilst reducing the stress levels of your staff.

Regular One-to-Ones: Having management carry out regular one-to-ones with all employees as a way to provide constructive feedback and allowing them an opportunity to raise an issue should they need to. These meetings should be adapted to suit their individual needs. Having the ability to request a meeting outside of their normal schedule if they need to discuss anything important will give managers a higher degree of approachability.

These one-to-ones could provide the opportunity to solve underlying issues related to work before they can spiral into something more significant. They will also boost employee engagement and strengthen the trust placed in the organisation so anyone who needs help will receive it as quickly as possible. Meetings such as these can serve as the backbone to staff wellbeing analysis and monitoring that is conducted throughout the company.

Gratitude in Action: Bring awareness to employees regarding the positive things in their life is a simple but effective method of elevating moods. Once an individual is aware of what opportunities they have and the contributions they make to the company they will transform this gratitude into personal responsibility. When perspective is given to certain stressful situations, employees can feel more in control and operate better than they would if they had not come to appreciate certain aspects of themselves and their occupation.

Significant Triggers of Mental Health Illness

It is important to consider all of the potential workplace triggers that may produce stress and develop mental health problems when looking to implement relevant wellness policies. These triggers cover a plethora of situations, such as:

- Poor managerial support.

- Long working hours with few break periods.

- Excessively pressurised workplaces.

- Isolated working environments.

- Lack of job security.

- Unmanageable workloads which employees have no control over.

- Unsuccessfully implemented change.

- Ineffective internal communication.

- Dangerous working environments.

- Impractical deadlines and expectations.

- Inability to take holiday breaks.

Be mindful and empathise with your employees, think about what difficulties they will experience in everyday work. Send out a survey asking for feedback on what your workforce identifies as the most prevalent workplace triggers of stress. Doing so will help shape a wellbeing strategy and can also provide insight on whether your staff are allocated work as efficiently as possible. Inadequate consideration of factors such as having too few work breaks can have a negative impact on the overall quality of products or services that your company delivers.

Evaluation of Staff Mental Health Wellbeing Policies

In many ways, mental and physical health are alike: everybody has both and they need to be nurtured and cared for to ensure wellbeing is upheld. Positive mental health means being able to think, feel and react is the ways you need and want to live your life. Going through a period of mental illness will affect the ways in which a person thinks, feels and reacts becoming more difficult to cope with.

Sensitive issues need to be dealt with in an appropriate way to ensure the illness is not worsened. Applying the outdated approach of pressuring an employee to keep working and to “Man Up” is far and away one of the worst ways to deal with mental health. Having a wide-ranging and inclusive wellbeing policy will provide the necessary guidelines for management to resolve any psychological issues which may arise.

Too often people at work will bottle up all of their negative emotions, neglecting to act until serious ramifications occur. This will inevitably lead to prolonged absences from work, affecting both themselves, and their company, is a financially detrimental way. This in turn can lead to even more issues. Accordingly, more and more businesses are coming to the realisation that caring for an employee’s mental health is not only viable for social corporate responsibility but will also produce a financial upturn in the long term. Having a comprehensive mental wellbeing framework is a sign of a competent, modern company.

Financial Wellbeing

Caring about your employees’ financial wellbeing is a smart business venture, and one that will optimise your workforce whilst addressing potential risks before they worsen. The connection between debt, stress and fiscal anxiety, absence and reduced productivity are increasingly being recognised by employers. Integral to any capable wellbeing policy is an understanding of the importance of how financial difficulties can affect employee physical and mental health. It is necessary to acknowledge that companies, as income providers, play a fundamental role in their workforces’ financial affairs.

The role of an employer as the driving force behind a wellbeing strategy is well documented, with approximately 70% of multinational organisations utilising some form of initiative. However, the focus on physical health and mental wellbeing has been given more attention over the years. Financial elements lag behind or are overlooked completely with only 42% of multinational companies and far few smaller companies addressing said issues.

Businesses are already feeling pressure from widespread poor financial wellbeing on multiple fronts including: reduced productivity (22%); loss of talent (22%); higher short-term and long-term absences (both 19%); reduction in retirees (17%); and higher healthcare costs (13%).

The fact that financial wellbeing has not been treated as a priority is in part due to changes that have occurred in society, whereby the need to tackle financial problems has been more urgent. The rising costs of education and housing, corresponding with pension reforms has resulted in heavier financial pressures on the current workforce. The problems are likely to increase over the next decade and will require people to make some big changes in their spending habits, showing greater financial discipline than recent generations. In support of this is the statistic by the CIPD 2017 that over a quarter of employees feel less financially secure now than at the start of 2016. In addition, a YouGov report, commissioned by the CIPD, noted that there has never been a more crucial time for employers to support their staff in becoming financially independent.

Anxiety caused by a deficiency of financial awareness, inadequate pay levels, or a lack of employee benefits can negatively affective work performance. Furthermore, the perception that their contributions are not being acknowledged can have repercussions on an employee’s self-esteem, health and productivity. These benefits are intertwined with many of the benefits described prior regarding physical and mental health. Financial wellbeing seems to be an underpinning factor that can make or break a wellness policy as neglecting it can undo all of the progress made from only addressing physical and mental wellbeing.

A large section of people aged between 18 and 54 identify financial issues as their top concern. These issues often rank higher in terms of being detrimental to wellbeing than work-life balance or physical and mental health. To gain better insight regarding the implications of financial wellbeing and how it can negatively impact the bottom line of a business, the CIPD – Employee Financial Well Being Report will be referenced. This report found that financial stress costs the UK economy £120.7 billion and 17.5 million hours of work time annually. This is unsurprising as higher levels of financial stress result in higher absentee rates, with 8% of UK workforce taking time off work due to financially related stress (Neyber 2016). In addition, 6% of employees are reported as having health complications due to money problems.

Job performance suffers significantly when employees experience financial difficulty, as found by Barclays (2014), whereby every £1 million an organisation spent on payroll, there is an estimated 4% lost in productivity due to poor employee financial wellbeing. This has been attributed to a number of factors including; 8% of employees having spent time during the working day on money problems, 25% of employees stating that financial problems have preoccupied their mind when at work, and approximately 18% of employees losing sleep worrying about their finances leading to lower productivity rates.

Furthermore, it has been shown that employees have reduced cognitive performance at work when experiencing fiscal anxiety and are slower to process financial information (Shapiro and Burchell 2012). This bias will be particularly harmful for individuals undertaking pecuniary tasks and may negatively affect business performance.

Principal Obstacles to Implementing a Financial Wellbeing Policy

Neyber’s DNA of Financial Wellbeing Report (2018) conducted a survey of over 10,000 employees and 580 employers to build a clear image of an employee’s relationships with their finances. They found close to 25% of working-age adults have little to no confidence with regards to money management, whilst 60% struggle to run their finances day-to-day. These statistics depict a national workforce who lacks the sufficient knowledge and skills required to manage money.

Strain caused by financial imbalances can result in an abundance of health problems, from the aforementioned sleep deprivation and depression to high blood pressure and hypertension. Despite the seriousness and extensive amount of the population who suffer from money problems, the general British worker remains reluctant to discuss economic matters.

There are a multitude of reasons why this reluctance is present, with a primary cause being that financial stability is seen as a marker for success, and the perception that not being in a financially strong position would represent failure.

Recent improvements have occurred, however, with 44% of employees stating that they are more likely to discuss financial matters with their partner (10% increase for the prior year), and the likelihood of an individual attempting to tackle their own problems unaccompanied has decreased by 3%. A gradual increase in willingness to discuss financial difficulties can be seen. Nevertheless, a strong unwillingness to rely on, or disclose financial matters with an employer remains. Only 5% of employees surveyed would reveal monetary issues with a manager, and even less at 3% to Human Resources.

These finding are very worrisome by themselves, however, this obstacle is exacerbated by an apparent misunderstanding from employers. Employer respondents in Neyber’s Wellbeing Report thought that managers and HR would be a point of first contact for employees who had such issues.

The gap between reality and an employer’s perceptions of this circumstance is further misaligned, as when asked what they believe worries their employees the most, rather than reiterating their employee’s choice of financial and health topics, they stated work-life balance and workload were at the top. Despite over 65% of employers thinking that job performance was negatively affected by excessive stress, only a small amount of focus was given to stress caused by financial themes.

Young working people especially suffer from this disconnect, with a primary reason being the high borrowing rates that accompany their fluctuating income. Approximately 68% of 18 to 24-year olds said their income changes monthly, with 27% stating that this variance can be by more than 30%.

These findings make clear to employers that before implementing any sort of financial wellbeing strategy, they must highlight the impact fiscal worries can have on the workforce. Without the appropriate consideration given to these matters and the target recipients, any framework put in place will be ineffectively managed. Employers and management must understand the pivotal role they can play in their workers’ financial wellbeing.

Financial Wellbeing Framework Implementation

One of the key components to running an effective wellbeing initiative is providing financial education relative to the different stages of one’s life and career, as well as addressing situations that are may arise in everyday life. 55% of employees freely state that they would welcome more support, with this being a very prevalent opinion in young employees as there is a high likelihood that they will struggle in their coming years.

A modern, comprehensive framework will go beyond traditional retirement planning and encompass different methods for spending and saving money efficiently. Given the significant impact financial difficulties have on employee welfare, productivity and company performance, the provision of financial education represents a relatively cost-effective way for employers to limit some of these negative outcomes. The following topics should be considered for inclusion into any financial wellbeing education:

Benefits on Offer: Rewards and benefits form the most important building blocks for employees to use in improving finances. A transparent benefits and communication framework offers a tried and tested method of starting a financial education, building knowledge and awareness.

Signposting all of the possibilities an employee may have available to them is a good starting point. Depending on the company in question, there may be a number of benefits that an employee can take advantage of; child care, fitness memberships, life and dental insurance are potential options to name a few. Having brought these options to their attention, follow up by providing information on how an employee can make the most of the benefits they may enjoy. A case study by Aegon showed 21% of employees surveyed stated their employers do not provide sufficient information, with only 7% of employees offering face-to-face counselling and advice specialised towards them.

Employers hold a strong position in securing preferential agreements for their staff on key benefits such as car leasing, insurance premiums and retail vouchers. Yet for these options to be effective in providing financial wellbeing they have to be aware of how to utilise certain benefits and what influences these changes can have on their personal finances. See the ‘financial education’ tab below.

Introducing a Living Wage: The average real wage has seen a decrease of 5.7% since peak 2008, the consequences of this are that employees are struggling to be financially stable. The Living Wage Foundation offers accreditation to any employer who pays an independently calculated Living Wage to its staff. This calculation is based on what families require to live; as of January 2019, this figure stands at £10.55 per hour in London and £9.00 for the rest of the UK.

In addition to being beneficial for society, there are substantial rewards for implementing the real Living Wage. 93% of accredited employers report benefits since implementing this wage, with 86% reporting improved business reputation and 75% stated that staff motivation and retention rates have improved.

Savings and Retirement Coaching: Retirement is a life changing financial transition, and one which many people are unprepared for. All too often employees who have failed to properly plan for retirement cannot afford to retire in spite of being mentally being ready to. Having to keep working under these circumstances is bad for morale, engagement and productivity.

Ever since the new UK legislation has passed in 2015, individuals are offered more options in regard to pension schemes than ever before. From April 2015 onwards, once an individual is aged 55 and over, they have the newfound freedom to use their pension pot in any way that they wish. Employees who are provided with the appropriate information and guidance are able to make prudent decisions and lay the groundwork for a comfortable retirement. The key to preparing a good retirement is starting to save early.

Accordingly, it important that employees can be put on the correct track as soon as possible.

The UK auto-enrolment rules mean that everyone between the age of 22 and state pension age, earning more than the salary threshold (currently £10,000 a year) who works in the UK, must be automatically enrolled into a workplace pension. Although, this does not exclude employers from building upon this and delivering more value around pensions for their employees. A strong financial wellbeing practice would be offering higher employer contributions than the set minimum, with supplementary pension advice given, so that employees (younger individuals in particular) can understand the benefits of investing in retirement as soon as possible. With upwards of 90% of employees not understanding tax rules related to withdrawing pension funds, it becomes evident that pension education is a necessity. This would ascribe an attractive employment quality that could be used to entice potential recruit to join your business.

Retirement and saving ability go hand in hand, as having no savings will inevitably lead to a poor retirement. Unfortunately, a study by the Money Advice Service in 2015 found that only 28% of people have a savings buffer equal to three months’ income and 40% of adults have less than £500 in savings. This number shows just how poorly equipped the younger generations of employees are to deal with fiscal matters and that this subject must be given attention.

Budgeting: At its core, budgeting is the process of creating a plan on how to spend your money. Knowing how much money is coming in and going out may seem simple enough, however, all too often employees will not conduct an accurate breakdown of their expenses against their income. Without a clear picture and specific figures detailing what an employee’s financial status is on a monthly basis it is not possible to effectively manage debt or save for a rainy day.

The Close Brothers’ Financial Wellbeing Index, which assesses UK employees across several key areas for financial health. They found that ‘budgeting and planning’ was one of the lowest scoring areas, highlighting an urgent call to action for employers looking at financial wellbeing.

Fortunately, it is easier than ever to access tools which can help an individual organise their finances in an efficient manner. The Money Advice Service is a service set up by the UK government, offering free and impartial advice on a wide range of financial issues e.g. Homes and Mortgages. Promoting and utilising these tools will serve as a strong introduction for employees to start arranging their own finances.

Running seminars or one-to-ones instructing employees on the different aspects they should concentrate on would help educate employees, whilst being cost efficient enough not to disrupt the running of everyday business.

Maximising Tax and National Insurance Efficiency: By operating a HMRC approved salary sacrifice scheme it is possible for certain employees to take advantage of select benefits whilst reducing their overall taxable income. The scheme is an agreement to reduce an employee’s entitlement to cash pay, usually in return for a non-cash benefit.

This arrangement must not reduce the employee’s cash earnings below the National Minimum Wage rates, with every contract being altered should an individual opt into the scheme. The impact on tax and National Insurance contributions payable will depend on the pay and non-cash benefits that make up a particular arrangement.

For example, taking £50 from a £400 per week salary to convert into Childcare vouchers of the same value would mean that only £350 is subject to tax and National Insurance contributions. This being due to childcare vouchers being exempt from both tax and Class 1 National Insurance contributions with a cap at £55 per week.

As is evident from this example, various non-cash benefits will come with their own advantages and employers can help their staff members make the most of their money. By focusing on potential benefits an employee can make substantial savings each year, helping with numerous financial choices such as budgeting and debt management.

Financial Wellbeing Evaluation

The importance of financial wellbeing on an employee’s mindset has been made clear from the aforementioned statistics, describing the adverse effects fiscal irresponsibility can bring about. The CIPD’s 2016 “Growing the Health and Wellbeing Agenda” summarised the necessity of financial wellbeing. This report called out for the required shift in how employers regard wellbeing, from taking a reactionary approach to being more proactive in the prevention of problems and recognising that financial wellness can influence physical and mental health. If one of the three elements are missing, the imbalance will impact the other two.

An advantage of educating a workforce in pecuniary matters will be that as they learn the ins-and-outs of their own finances, they will become more and more independent. When a solid understanding of money is installed into key members of your staff the likelihood of other staff members becoming more open about their own finances will increase. Inevitably staff retention rates will increase and productivity levels will rise.

Financial wellbeing is strongly recommended as being a part of an integrated and holistic approach to employee wellbeing and being a key component of a healthy workplace. As the human mind can only process a certain number of things at once, by supporting staff and encouraging productive and open dialogue with regards to personal finances, it is possible to reduce many of the pressures and worries that may be pre-occupying part of a workforce. Doing so can only result in producing a happier, healthier and more productive workforce.

Wellbeing Policies and SME’s

Whilst bigger companies are placing increased emphasis on staff wellbeing and the introduction of progressively more safeguards, many smaller businesses often take they approach “we are too small to make use of staff wellbeing” and imply that they have inadequate resources to effectively install a policy.

The House of Common has stated that 99% of UK businesses are classified as SME’s, with 96% being categorised as micro-businesses with less than 10 employees in total. In 2017, over 12 million working days were lost as a result of poor mental health, with the estimated losses being upwards of £26 million due to lower productivity. Linking this to the UK’s 5.5 million SME’s, which form the pillar of the UK economy, it becomes apparent that when discussing the cost of poor wellbeing and worker absence, it is the disproportionate burden suffered by SME’s that should be given heavy focus.

Regarding a company with many hundreds of staff, having a couple of staff off each day due to wellbeing issues are easy to account for and cover. However, for an SME with 10 or less employees, a single absentee would result in a 10% loss in productivity. Should this coincide with a holiday break for another employee and a substantial percentage of a business’ workload is going unfinished. Accentuating this further is the fact that in 2017 one in seven SME employees were absent for four weeks or more with a yearly period. From this alone it should be obvious that putting safeguards in place to ensure mental, physical and financial wellbeing is a valuable investment and sound business decision.

Despite the significant impact any absence can have on an SME, the majority of SME’s believe that they are too small to implement a wellbeing policy. It has been found that a third of small business owners think that wellbeing initiatives are a device used exclusively by larger firms, with 43% conceding that they have never considered offering any wellbeing benefits.

Small businesses must realise that wellbeing is something they can and should do. Numerous items for consideration have already been listed, and SME’s can implement simple steps that will have a considerable positive impact. From ensuring staff have proper lunch breaks, to offering more flexible work hours, or having an open-door policy; all these changes do not require significant preparation or investment but can reduce absenteeism greatly.

Drawing from the numerous options already listed a SME’s owner should carefully consider what ways they can combat staff absences. Picking one or two options for each wellbeing factor could be an appropriate and sufficient way in which major wellbeing issues are dealt with early and properly. An SME employer ought to take advantage of the ‘family’ feel that many SME’s have, with workforces being closer knit to build a wellbeing policy that fits a specific employee base.